Indices

Index Press Release - 1 March 2012

EQUAL WEIGHTED HEDGE FUND INDICES

ASSET WEIGHTED HEDGE FUND INDICES

SPECIALIST ALTERNATIVE FUND INDICES

INVESTIBLE BENCHMARK INDICES

METHODOLOGIES

INDEX PRESS RELEASES

- Index Flash Update (June 2022)

- Index Flash Update (May 2022)

- Index Flash Update (April 2022)

- Eurekahedge launch four benchmark indices tracking volatility-based investment strategies

- Eurekahedge and MPI announce new benchmark index tracking the top 50 hedge funds

- Eurekahedge and ILS Advisers launch new USD hedge index

- Eurekahedge launches new insurance linked securities index

- Eurekahedge Asset Weighted Index goes live

- Eurekahedge Asset Weighted Index press release

- EU Benchmark Regulation

| Eurekahedge launches new insurance linked securities index |

|---|

|

SINGAPORE (March 01, 2012) - Eurekahedge, a market leading alternative fund data provider, announced today that they have launched a new hedge fund index focusing on insurance linked securities, in partnership with ILS Advisers. The new index is named the

‘Eurekahedge ILS Advisers Index’. The index can be found at:

www.eurekahedge.com/Indices/ils_advisers_index_press_release. |

| Robust Returns | ||||||||

|---|---|---|---|---|---|---|---|---|

|

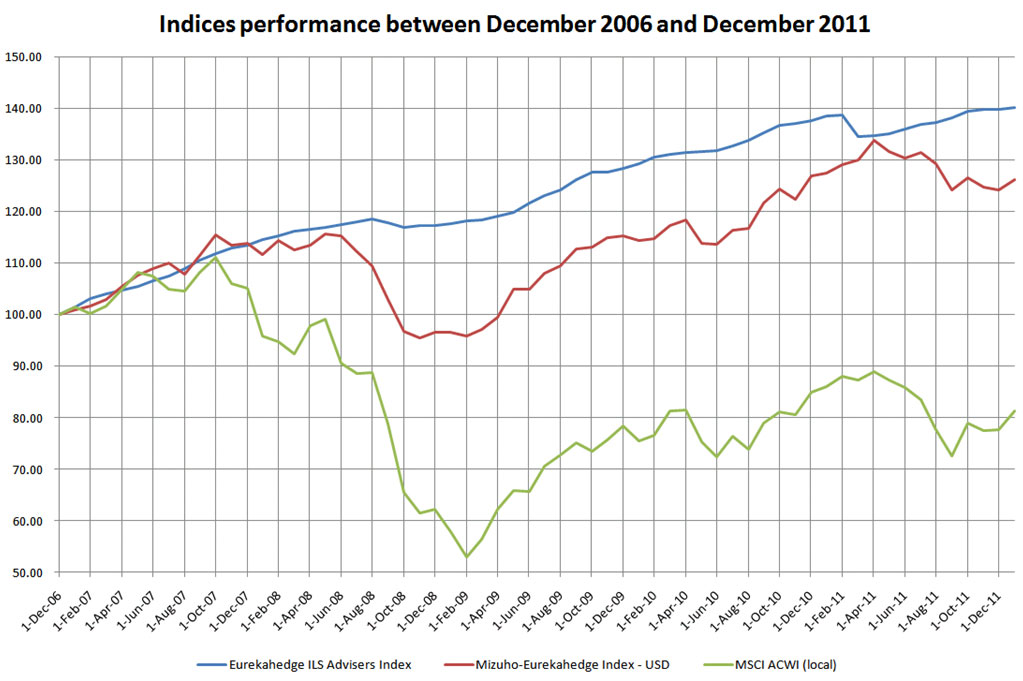

Investing US$1 million in the following 3 indices at the end of December 2006 would have yielded the following gains over the last five years:

|

| Downside protection |

|---|

|

Equity markets were severely affected during the financial crisis between May 2008 and February 2009. The MSCI All Countries World Index fell 46% over this period and has yet to recover. The Mizuho-Eurekahedge Index fell 17% and took almost 2 years to recover. In contrast, ILS funds returned, on average, 1% to their investors. Even major catastrophes, which have a direct effect on the insurance market, have had a minimal impacted upon the index. The Tōhoku earthquake and tsunami that occurred in Japan, in March 2011 (which could be classed financially as a Lehman-style event for the ILS industry) caused the Eurekahedge ILS Advisers Index to fall 3% - a comparatively nominal amount. Impressively, the index recovered that loss within 6 months. |

| Uncorrelated returns |

|---|

|

Insurance linked securities funds are largely uncorrelated to hedge fund returns and thus provide an attractive avenue of diversification for investors looking for a more balanced portfolio. The Mizuho-Eurekahedge Index and the MSCI All Countries World Index share a strong correlation (R2 of 0.64). The Eurekahedge ILS Advisers Index registers virtually no correlation with the Mizuho-Eurekahedge and MSCI indices (R2 of 0.11 and 0.1 respectively). |

| Volatility comparisons |

|---|

| About the index |

|---|

|

The Eurekahedge ILS Advisers Index is an equally weighted index of hedge funds that explicitly allocate to insurance linked investments and have at least 70% of their portfolio invested in non-life risk. The new USD hedge version of the index is base weighted at 100 in December 2005 and has returned 7.18% per annum with a volatility of 2.30% until the end of 2013. The Eurekahedge ILS Advisers USD Hedged Index utilises the month end FX spot rates and factors in the hedging cost for all non-USD denominated index constituents. |

| How insurance linked securities work |

|---|

|

Insurance linked securities (ILS) also known as catastrophe or cat bonds are a transfer of insurance risk to the capital markets typically by insurance or reinsurance companies. The performance of ILS depends on the occurence respectively non-occurrence of an insured event. ILS show a low correlation with traditional asset classes and other alternative investment as shown above. ILS are typically not exposed to duration risk or interest rate risk since their return consists of a variable interest rate component plus an insurance premium for the risk assumed. Moreover they protect investors against inflation. Typically the ILS funds diversify their exposure across different perils such as natural catastrophe (wind, earthquake), man made risk and across different geographies US, Europe and Asia. |

| Notes for editors |

|---|

|

Quotes Mr Mearns goes on to say, “In the current market environment trying to find superior risk adjusted returns is like looking for black cats in a coal mine. Insurance linked securities hedge funds are those cats!” “The launch of the Eurekahedge ILS Advisers Index shows our commitment, to identify and monitor the best ILS managers globally and bring them to professional investors in Asia”, says Stefan Kräuchi co-founder of ILS Advisers. “The new index combines the expertise of ILS Advisers in the insurance linked investment space with the know-how, experience and reputation of Eurekahedge as the top index provider in the alternative investment area. A perfect match”, says Stefan Kräuchi, co-founder of ILS Advisers. “The new index will bring additional interest to an asset class that is

still barely known in Asia despite its stellar track record over the last ten years with high yield

bond like returns, a volatility of less than high grade corporate bonds and no negative year”,

says Stefan Kräuchi. The purpose of ILS Advisers is to develop the Asian market for Insurance Linked Investments. ILS Advisers are strictly an independent investment consultant and not managing nor selling own products. ILS Advisers identify and monitor the best ILS managers and products globally and bring them to professional investors in Asia. ILS Advisers help clients to understand the asset class, support them in their selection and investment process and provide ongoing services once the investments are made. Target clients are Asian domiciled institutional investors such as Sovereign Wealth Funds (SWF), Pension Funds, Banks, Corporate Treasuries, Family Offices and Fund-of-Funds. Stefan K. Kräuchi has over 20 years of international experience in the in the asset management industry with UBS, AIG Investments (now PineBridge) and Credit Suisse Group in Zurich, Tokyo and Chicago. In his previous role he was a member of the Executive Board of a large Swiss private bank, where he was in charge of the products and services division with assets under management of over USD 20bn including insurance linked investments of over USD 2bn. Since 2004 he has been instrumental in pioneering and developing products in the ILS space for the Swiss and European market. Hansrudolf Schmid is the founder and president of HSZ Group. After an education in law he pursued his career in finance, covering investment banking, private banking and investment management, first in New York followed by Zurich and Hong Kong. Further Information on ILS Advisers can be found at www.ilsadvisers.com About Eurekahedge Founded in 2001, Eurekahedge is an independent financial data and research company focusing on alternative investments. Eurekahedge maintains coverage on 26,000 alternative funds globally and its research covers hedge funds, funds of funds, UCITS III hedge funds, private equity funds, Islamic funds, real estate funds, SRI funds and long-only absolute return funds. In addition to fund data Eurekahedge publishes the world’s largest suite of over

250 alternative investment benchmark indices, and the widely read The Eurekahedge Report, a

monthly look at the alternative funds industry’s asset flows, fund performance, macroeconomic

trends and league tables. For further information please contact:

Christine Chng Alexander Mearns

Eurekahedge Pte Ltd Ms. Joey Tang Stefan K. Krauchi ILS Advisers

|